This article provides a detailed explanation of the cashier report.

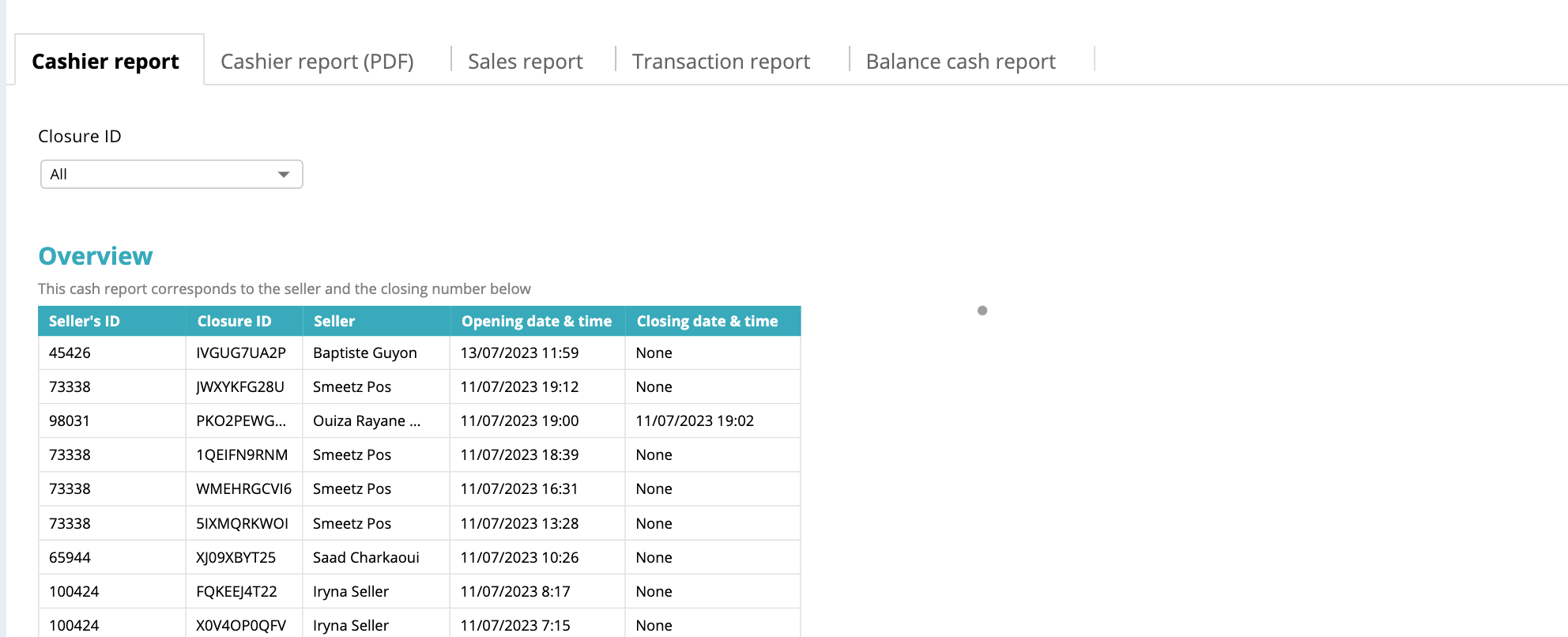

The cashier report is specific to transactions made at the point of sale (POS). Each closing of the cash register is identified by a unique identifier. This report provides an overview of the data and serves as a log for all sales and closures performed by each cashier. It allows you to view the complete sales history as well as specific details of each closure made by each cashier.

How to access the cashier report

Statistics > Compatibility > Cash report (new)

At the end of each day, when you close your sales, the cashier report of this closure is generated. To access this report, you will need to filter the data using the unique closing identifier.

Presentation of the cashier report

1. Overview

In the "Overview" section, you will find the following information to give you a general idea of the activities and schedules of each seller:

- Seller's ID

- Closure ID

- Seller

- Opening date & time

- Closing date & time

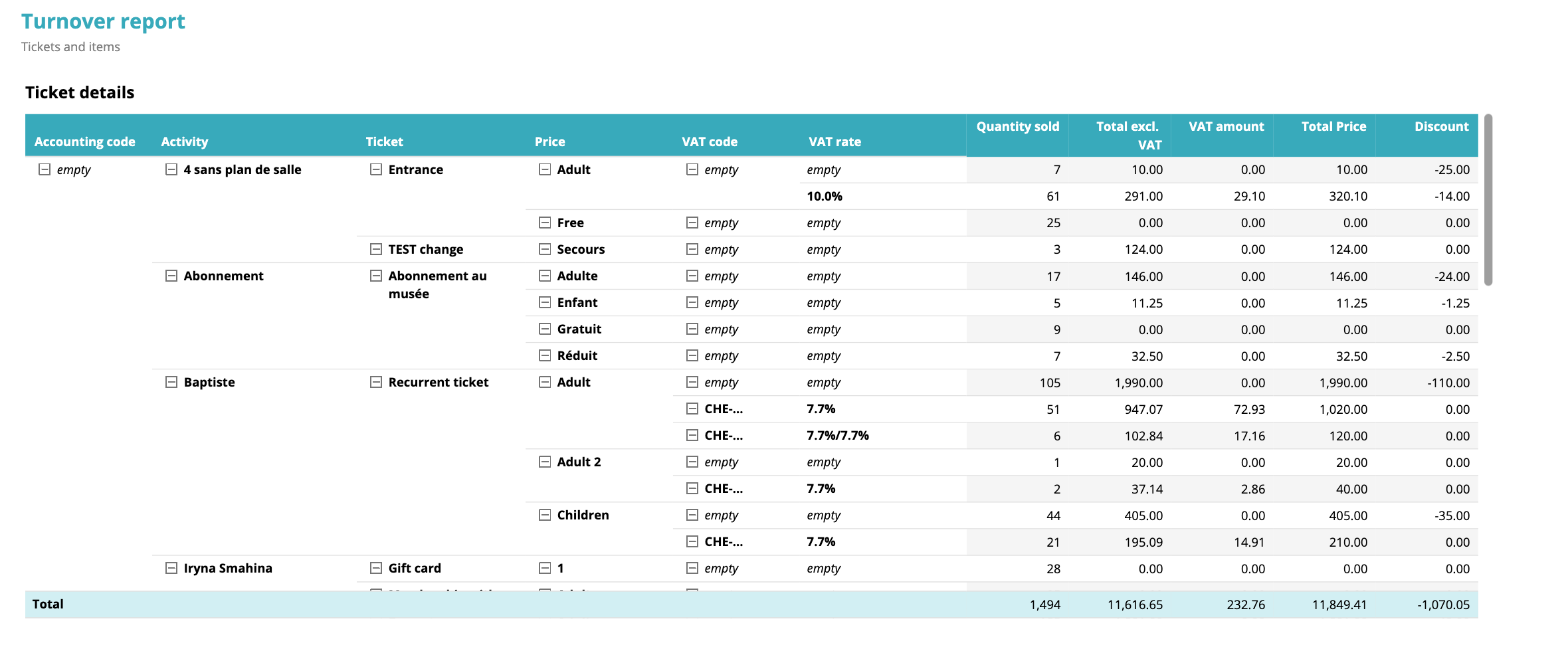

2. Turnover report

-

Ticket details: This section displays specific information related to ticketing.

-

Details of the articles: This section concerns data related to retail products.

2.1 Ticket details

You will find the following information

- Accounting code: This code allows organisers to differentiate their sales according to specific accounts or categories.

- Activity: The name of the activity or event associated with the ticket.

- Ticket: The name associated to each ticket.

- Price: The price category of the ticket.

- VAT code: The code indicating the VAT applicable to the transaction.

- VAT rate: The percentage of VAT applied to the transaction.

- Quantity sold: The valid quantity of tickets sold.

- Total excl. VAT: The total amount of sales after taking into account cancellations and discounts, excluding VAT.

- VAT amount: The amount of VAT calculated for the transaction.

- Total price: The total price, including VAT, calculated as the sum of the total excl. VAT and the VAT amount.

- Discount: Any reduction or deduction applied to the original ticket price, resulting in a reduced price for the transaction.

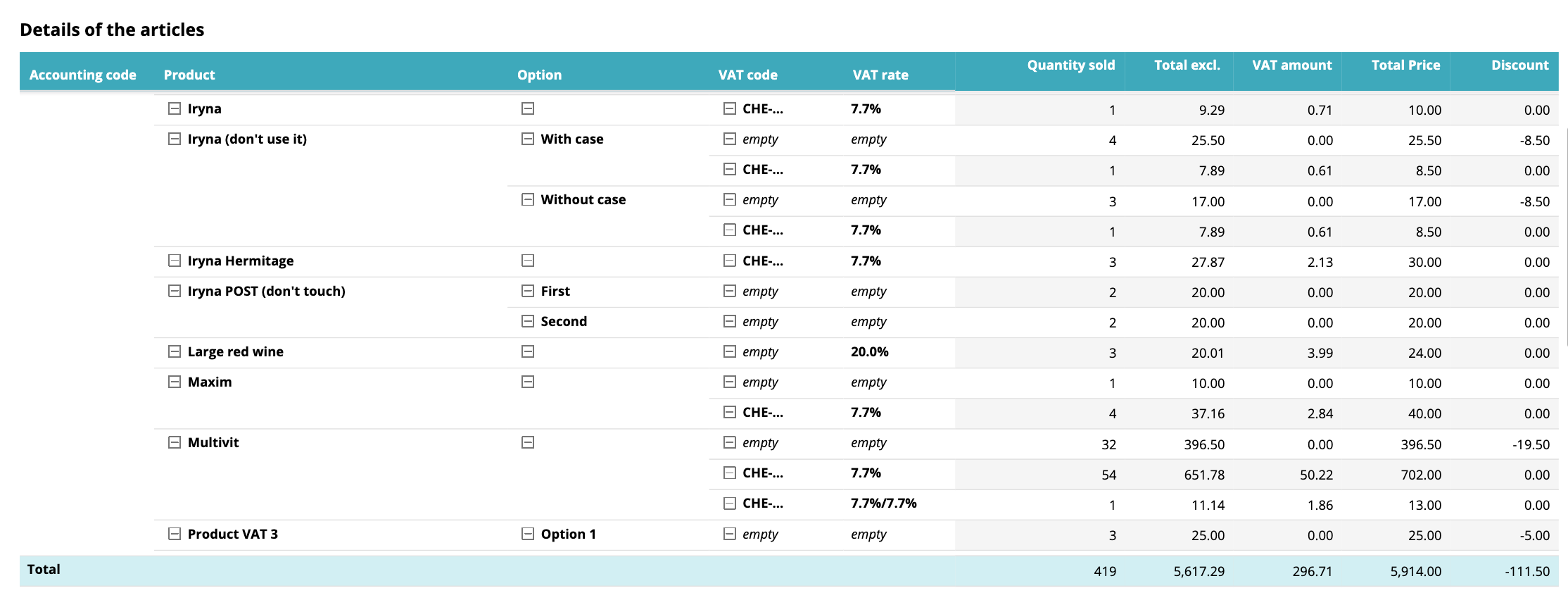

2.2 Details of the articles

2.2 Details of the articles

The information provided is related specifically to the articles and their options, rather than to the activities and their prices.

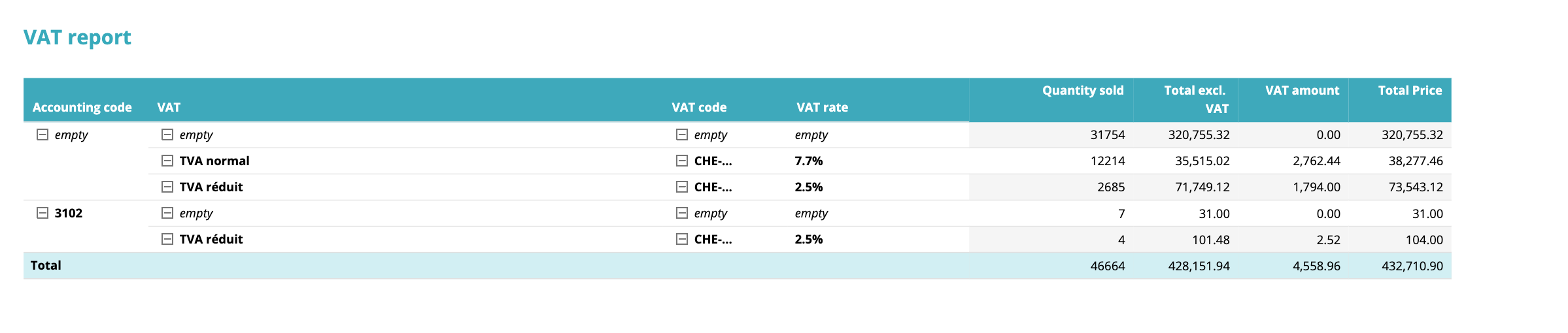

3. VAT report

The VAT report is a summary focusing specifically on VAT-related information. It includes the following details:

- Accounting code: This code allows organisers to differentiate their sales according to specific accounts or categories.

- VAT: The type of VAT applied.

- VAT code: The specific code assigned to identify the VAT.

- VAT rate: The rate in percentage applied to calculate the amount of VAT.

- Quantity sold: The total quantity of tickets/products sold associated with this specific VAT category.

- Total excluding VAT: The total amount of sales excluding VAT.

- VAT Amount: The VAT amount applied.

- Total price: The total price, including VAT, calculated as the sum of the total excluding VAT and the VAT amount.

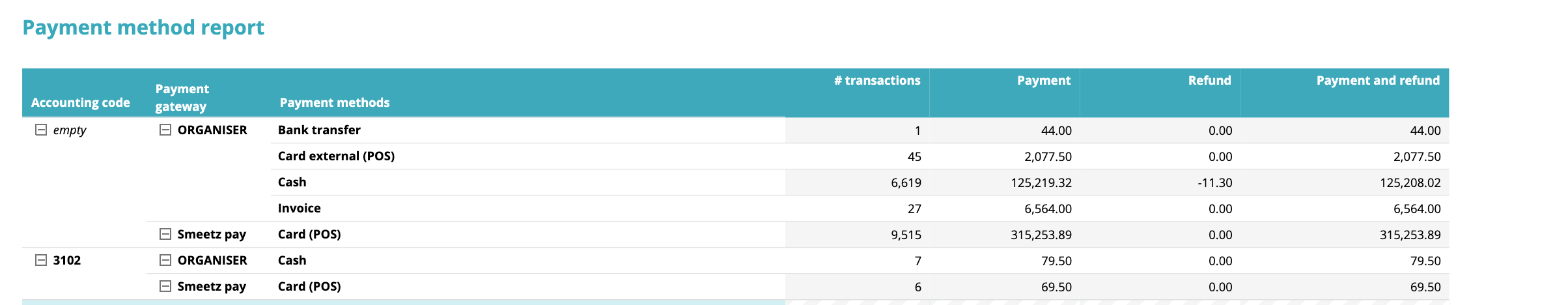

4. Payment method report

This table also includes the payment stage. At this stage, the following details are provided:

- Accounting code: The code used for accounting purposes related to the specific transaction.

- Payment gateway : The payment gateway through which the payment is processed. This may be:

- Organiser's payment method: This indicates the method used by the organiser to receive payments, such as bank transfer, external card payment terminal (Point of Sale), cash, etc.

- Smeetz Pay: This category includes Smeetz specific payment methods such as Mastercard, Card Payment Terminal and other relevant payment options. It is important to note that all transactions go through the Adyen payment system.

The table also shows the following indicators:

- # transactions : The total number of transactions recorded during the specified sales period.

- Payment: The total amount received in payments.

- Refund: The total amount refunded for transactions.

- Payment and refund: This indicator represents the sum of the amount of payments and the amount of reimbursements, providing an overall picture of payments and reimbursements during the sales period.

5. Cash fund report

This is where you can see the amount of cash on hand at the closing time.

Presentation of the cashier report (PDF)

Under this tab, you can generate a printable or downloadable summary in PDF format (this may take a few minutes).

You can use the same filter available on the cashier report sheet to customise the PDF report generated.

Presentation of the sales report

The sales report includes three tables which are also included in the cashier report, but with one major difference: the ability to filter by product name, ticket/option name and price.

- Overview

- Ticket details

- Details of the articles

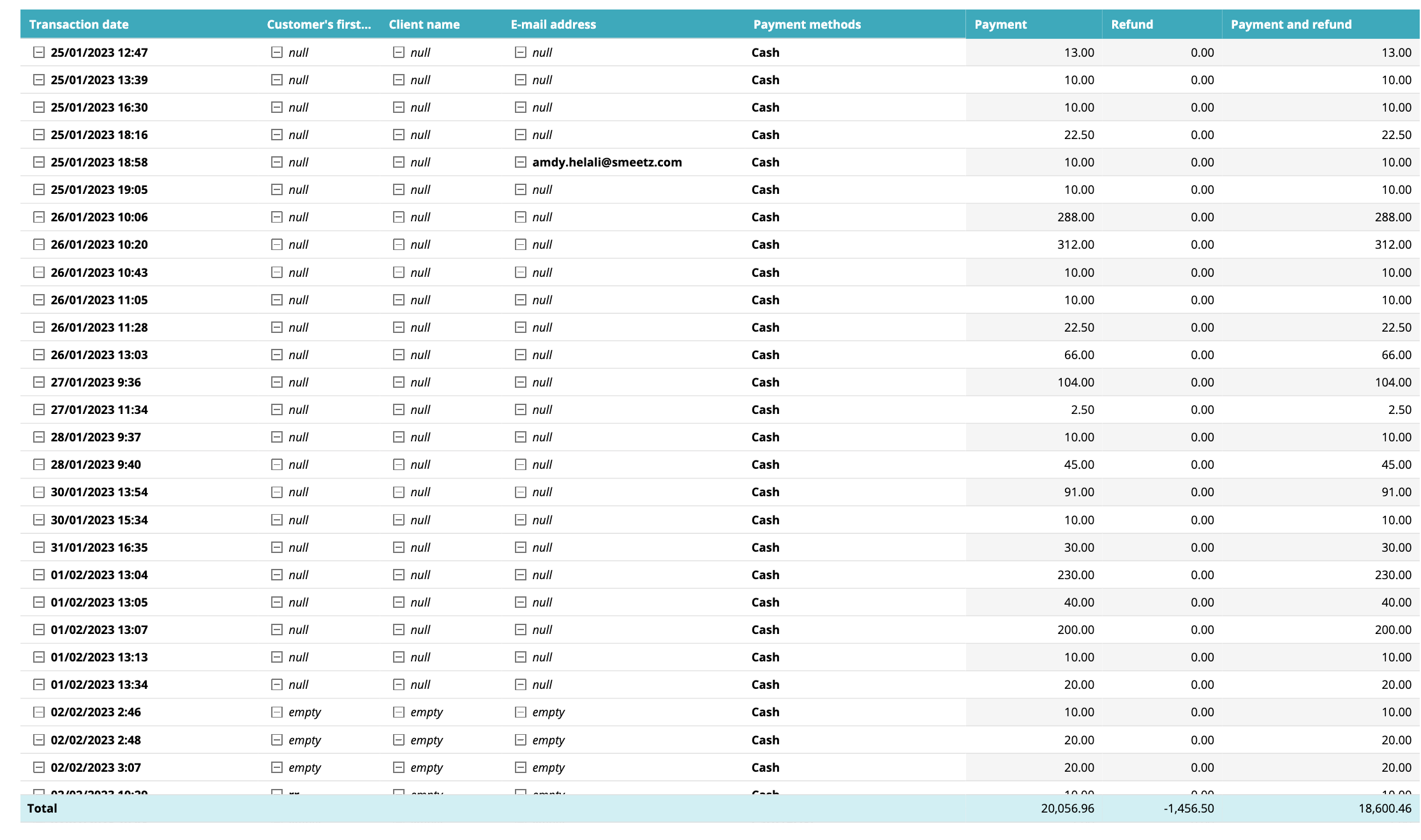

Presentation of the transaction report

The transaction report provides full details of payments and refunds.

First of all, it allows you to filter by:

- Closure ID

- Payment method

- Activity name

- Ticket name

- Price

- Product

- Option

- Transaction date

- Customer's first name

- Client name

- Client email address

- Used payment methods

- Payment: The total payment received.

- Refund: The total amount refunded for each transaction.

- Payment and reimbursement: This measure represents the sum of the amount of payments and the amount of reimbursements, providing an overview of the financial situation of payments and reimbursements during the sales period.

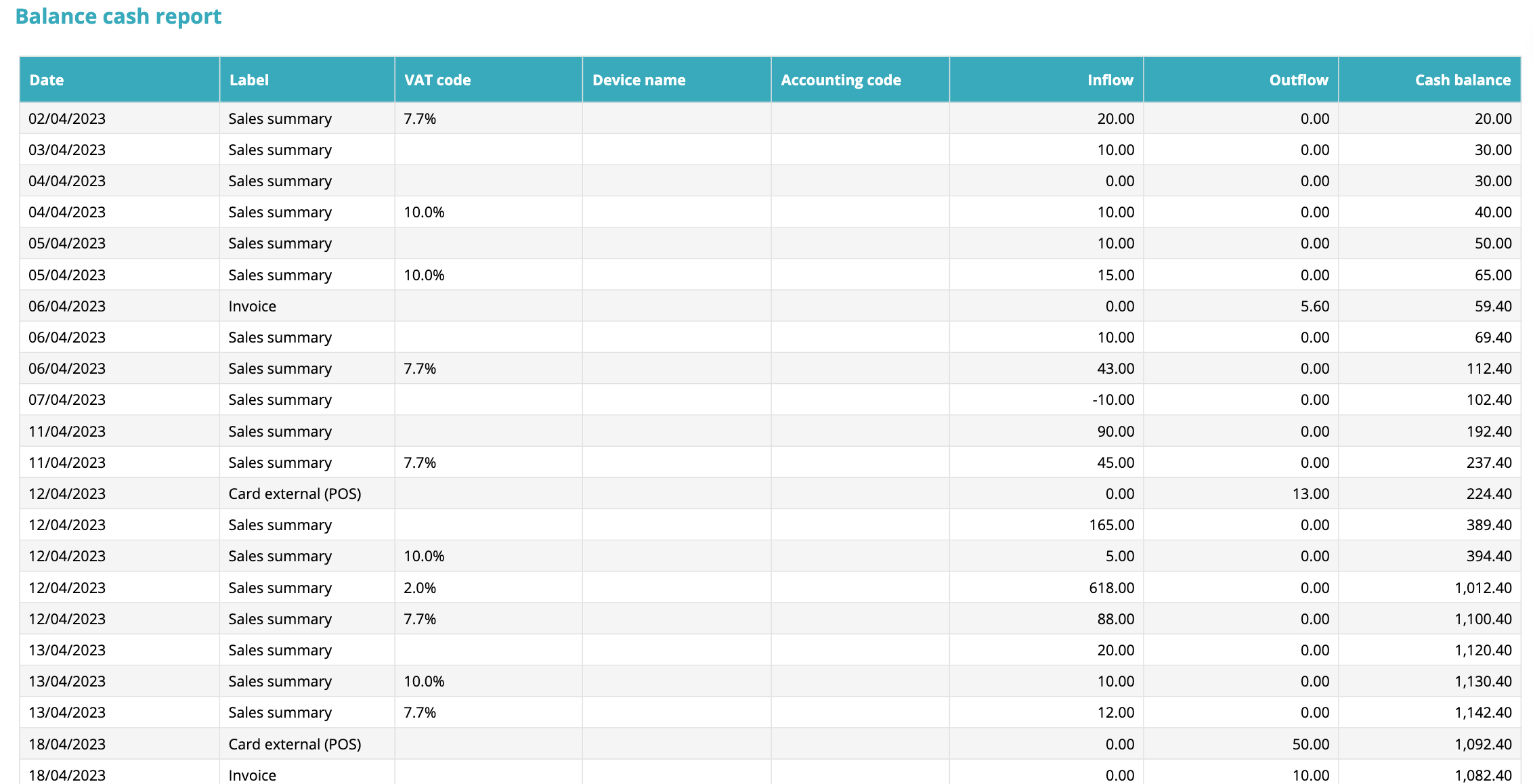

Presentation of the balance cash report

This report provides information on the movement of cash.

First of all, it allows you to filter by:- Start date

- End date

- Device name

- Date

- Label

- VAT code: VAT is only applied to tickets. VAT may be waived on certain tickets in the following cases: VAT-exempt ticket, free ticket, ticket with 100% discount.

- Device name

- Accounting code

- Inflow: When VAT is included, the ticket price after cancellation and discount is displayed. If the VAT is excluded, the ticket price after cancellation and reduction is shown, plus the VAT amount.

- Outflow: This is the sum of payments and refunds, including all payment methods except cash.

- Cash balance: represents the difference between inflow and outflow.

Please note that in some cases, where a 100% discount or a free ticket is applied, there may still be a quantity sold, but the VAT amount and the total excluding VAT will be 0. This is due to the absence of any chargeable amount associated with such transactions.