This article will give you a better understanding of taxes and how to set up your own taxes according to your activities.

- What is a tax?

- How to create a tax on Smeetz

- How to link the taxes created to your prices

- How to remove taxes

1. What is a tax?

In this article, we will use the example of Swiss value-added tax (VAT) to illustrate the process. However, you can add and create different taxes according to your needs.

Value Added Tax (VAT) is a general consumption tax paid by the final consumer. Consumers pay VAT through the purchase of goods (clothes, cars, food, etc.) and services (hairdressers, transport, restaurant meals, etc.). A company must include the value-added tax in the price of services provided and products sold in the country and pay it to the government.

In addition, it can deduct from this amount the input tax paid in the course of its business.

1.1 The 3 types of VAT rates in Switzerland are:

- The VAT rate is 7.7% for most goods and services.

- A reduced rate of 2.5% is levied on certain goods of daily use such as foodstuffs, non-alcoholic beverages, books, newspapers, magazines and medicines.

- A special rate of 3.7% is applied to overnight stays in hotels (including breakfast).

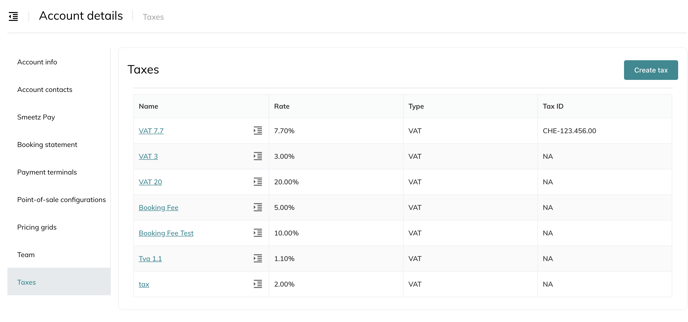

2. How to create a tax on Smeetz

- Login to Smeetz

- Click on your profile (initials)

- Go into account details > Taxes

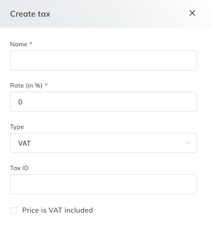

- Click on Create a tax

- Please enter the following information in order to create your tax:

-

Tax name: Ex: Reduced VAT

-

Tax Rate: Ex: 3.3%

-

Tax Type: Ex: Vat

-

Tax ID: Ex: CHE-123.456.00

-

Price is VAT included: This will define if the tax will be added to the price value or deducted

-

If checked → The VAT will be deducted from the main price

-

-

If price value = CHF 10.00 + VAT (20%) → Tax amount = CHF 2.00

-

Final sales price = CHF 10.00

-

-

- If un-checked → The VAT will be added

-

-

If price value = CHF 10.00 + VAT (20%) → Tax amount = CHF 2.00

-

Final sales price = CHF 12.00

-

-

-

-

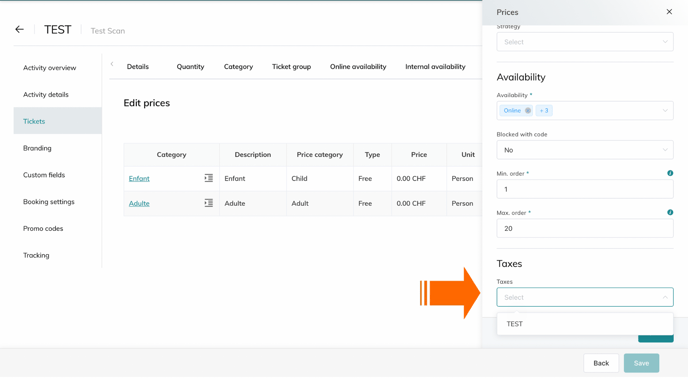

3. How to link the taxes created to your prices

- Go to the "products" tab > select an activity (where you want to apply your created taxes)

For more information on creating a product, please check this article. - Then click on Tickets > select the ticket to which you want to apply your created taxes

- Click on Prices > select the price name (e.g. children, adults, seniors)

- Go to the taxes section (at the bottom of the pop-up)

- From the tax section > link the name of the tax that you would like on these prices.

- Please remember to Save your action

Please note that you can change the taxes on your prices at the end of each event.

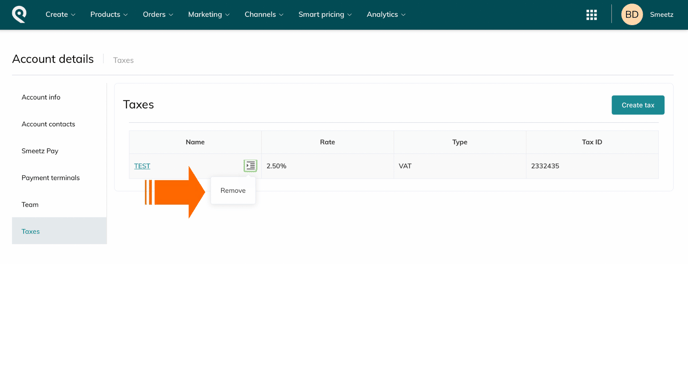

4. How to remove taxes

- Click on your profile (initial)

- Go into account details > under Taxes

- Click on the small lines in arrow format and delete